How To Diagnose What Is Going Right – And Wrong – In Your Sales Production System

Lots of companies feel pressure at some time or another to improve the effectiveness and productivity of their sales force. Unfortunately, instead of diagnosing what is really going on, they just jump in with presumed solutions instead: sales or negotiation training, CRM software, lead generation, or some other of the Usual Fixes.

Unfortunately, the success record of initiatives started in this way is dismal. When they don’t work, everyone naturally wants to try something else. It becomes the “flavor of the month” syndrome. Sound familiar?

“Undesirable Results” Are Key to Diagnosing Root Causes in Sales

The World Class Sales Process Self-Assessment gives you a head start on identifying real causes of sales and marketing problems. It provides you with seventeen statements that are, in our experience, likely to be an Undesirable Result in many sales and marketing organizations. For example, “My salespeople are spending too much time on the wrong accounts” is NOT an undesirable result, because it is a matter of opinion and not observable or measurable. However, “My salespeople don’t use the same standards to prioritize their accounts” is a UDR, because it is something that can be observed and measured. (UDRs are an important concept in sales process excellence: here are two resources to help you learn more: 1, 2)

It sometimes takes effort to process your perceptions of a business problem so that you can express it in terms of a UDR, but when people see or hear a UDR, it usually “clicks.” The effort to develop UDRs in your own business is well worth it. Just like a doctor diagnosing a disease, to avoid mistakes you have to stay close to observable data, and away from emotions, assumptions, or opinions about the causes and countermeasures.

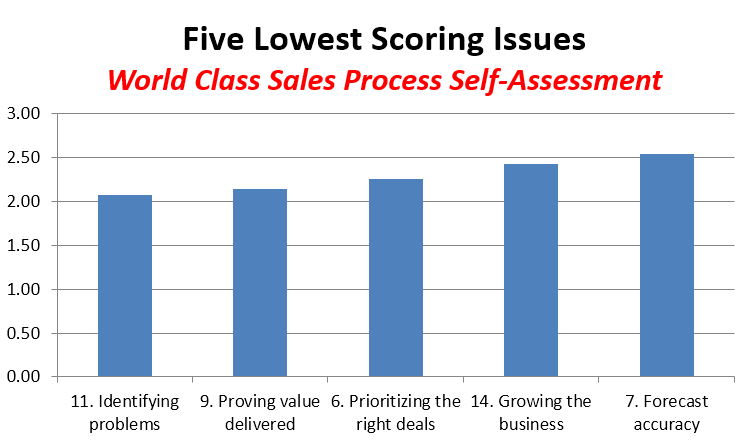

Of course, you need to work out the cause system in your own unique situation. However, it can be instructive to see how this works, so we’ll do a simple diagnosis by examining the five most challenging issues reported so far the World Class Sales Process Self-Assessment (based on both medians and averages):

Two of the biggest issues reported are in the “Management” category:

- 11. Identifying problems:

LOW: It is hard to know what is working and not working with salespeople in the field.

HIGH: Numbers and visual charts show us where our sales problems are. - 14. Growing the business:

LOW: It seems like we must work harder every year.

HIGH: Our people try new approaches that seem to work smarter and better each year.

The standard deviation of “11. Identifying problems” was the lowest in the database by a wide margin. That means there is strong agreement that this is a problem across industries.

Moreover, consider these two management issues together: Doesn’t it seem like there might be some kind of connection between them? I mean, if we can’t identify “what is working and not working in the field,” is there any wonder why it seems like we must “work harder and harder every year?”

You might be itching for a solution to this. For now, be assured these problems are solvable, and absolutely worth solving. However, it is a bad idea to go there until you have thoroughly understood what you are dealing with. After all, you wouldn’t want to mistake an upset stomach for appendicitis.

The next category of questions, “Winning,” also contained two of the lowest scoring issues:

- Prioritizing the right deals:

LOW: Salespeople each have their own way to prioritize their deals.

HIGH: Salespeople share a numbers-based approach to prioritize the winnable deals from walk-aways. - Forecast accuracy:

LOW: We often can’t predict which accounts will buy and which ones won’t.

HIGH: Our sales forecast accuracy exceeds 90%.

Interestingly, the scores on Forecast accuracy also displayed minimal deviation. Again, if “Salespeople each have their own way of prioritizing deals,” might that have anything to do with the fact that “We often can’t predict which accounts will buy and which ones won’t?”

Let’s go even further: If “Salespeople each have their own way to prioritize their deals,” is there any wonder “It is hard to know what is working and not working with salespeople in the field?”

Again, let me assure you there are excellent and simple ways of solving these problems, and I don’t mean regimentation or forcing people to conform to things they don’t want to conform to.

But before we get there, consider the remaining issue in the lowest scoring issues of the World Class Sales Process Self-Assessment:

- Proving value delivered:

LOW: No one formally studies why customers value our products and services.

HIGH: We study our customer’s experiences which gives us an edge in selling our value.

This was the second lowest scoring issue. Which means it is pretty bad. As with the other questions, is it possible there are some potential causal relationships here?

Diagnose Causes and Effects in the Sales Production System

Obviously, these are major issues when an organization has them, and we are barely skimming the surface here for how to solve them. But getting an overview of the approach is helpful for most management teams. A great exercise with your team is to ask them to create UDRs (it is best to be dealing with facts, after all), and then write each of these UDR statements on a post-it-note™. This lets you arrange them visually and draw lines between them to indicate causal relationships.

If you try it with the items in our assessment, you might get a cause-effect tree that looks something like this:

Is this proof of anything? Nope. Does it get discussion going in your team? Something is wrong if it doesn’t! Can you get data to confirm or contradict any of this?

That is a great place to begin. Often, people from different parts of the organization have different perspectives, and different access to information. Getting the data and reconciling it to the theory on your cause and effect tree is a great way to build consensus and clarity on the problems.

What’s the next step? Easy. Ask why? And ask it again.

- Why does no one formally study why customers value our products and services?

- Why do salespeople each have their own way to prioritize their deals?

- Why is it hard to know what is working and not working in the field?

The answers to these questions, and all the additional questions and data you will need in pursuit of the answers will give you lots of ideas for potential countermeasures. Testing these potential countermeasures in a small way by trying to predict measures that will change when they are implemented will give you even more confidence you are on the right track.

There is one more track you can take too: the same logical approach works for the things that are going right in your organization as well.

Often, the only thing standing in the way of improving your results is the way your people think. Following a data-driven approach like this is the most effective way to diagnose – and solve – what is going wrong and right with your sales production system. That’s because it respects data, and systems thinking. And best of all, thinking doesn’t cost a thing.

++++++++

SPC routinely performs assessments for sales organizations based on the principles in this article. Ask for an initial consultation.

For further information on this topic, you might like these articles:

How Do You Map A Sales Process?

How is Lean Different From Other Sales Process Methodologies?